Ecommerce Payment Gateways: Choosing the Right Solution for Your Store

The world of ecommerce thrives on seamless transactions, built-in trust, and limitless growth potential. But at the heart of this success lies a crucial element: the ecommerce payment gateway. Choosing the right one feels like finding the perfect dance partner – someone who moves in sync with your needs and empowers your business to waltz toward prosperity.

From understanding your target audience’s payment preferences to navigating the intricate world of fees and security protocols, we’ll equip you with the knowledge to choose the gateway that perfectly complements your business confidently.

By reading this article, you can get ready to eliminate confusion, optimize conversions, and pave the way for smooth, secure, and successful transactions.

9 Essential Factors to Consider

Let’s shine a light on these nine essential factors you need to consider, from deciphering your target audience’s preferred payment methods to ensuring rock-solid security and effortless scalability. By carefully mapping your needs to the available options, you’ll unlock the perfect gateway for your business and watch those conversions soar:

1. Target Audience

Understanding your target audience is paramount for selecting an ecommerce payment gateway. By analyzing demographics, such as location, age, income, and technological comfort, you gain valuable insights into their payment behaviors.

Tailoring your payment options to match their preferences, be it credit cards, digital wallets, or buy-now-pay-later (BNPL) services, ensures a smooth checkout experience, optimizing conversion rates for your specific customer base.

Conducting surveys or utilizing analytics tools to delve deeper into customer preferences allows you to make informed decisions about payment methods that resonate with your audience.

Engaging with your customers through feedback sessions or social media can also provide valuable input into their evolving payment expectations.

2. Transaction Volume & Value

According to a recent report by McKinsey, the future revenue growth in the payments sector is likely to be stimulated by instant payment innovations and the rise of digital wallets, especially in specific geographies.

Anticipating your store’s transaction volume and average order value is pivotal for choosing the right ecommerce payment gateway. High-volume stores require robust infrastructure and competitive fees, making it essential to align your needs with the gateway’s capabilities.

Consider whether the gateway offers tiered pricing based on transaction volume or order value, ensuring a cost-effective solution that scales with your business.

Additionally, evaluate the gateway’s scalability features; some providers may offer customizable plans that allow you to tailor your payment processing costs to match your growing transaction volume, ultimately optimizing your financial strategy for long-term success.

3. Payment Methods

Diversifying payment methods is key to accommodating a broad customer base. Supporting major credit and debit cards is fundamental, while including popular digital wallets like Apple Pay, Google Pay, and PayPal enhances the user experience.

Additionally, exploring alternative methods, such as BNPL services or regional payment providers, can align your payment options with your target audience and product offerings.

You should keep tabs on the ever-evolving payment preferences, stay abreast of emerging trends, and continuously update your payment offerings to cater to the diverse needs of your customers.

Periodically reassess the market to ensure your payment methods remain relevant and competitive.

4. Fees & Pricing

Carefully scrutinizing fees and pricing models is vital in selecting an ecommerce payment gateway that aligns with your budget. Compare transaction fees and monthly charges, and be vigilant of hidden costs like chargebacks or currency conversion fees.

Choosing a transparent provider with straightforward pricing models ensures you can accurately forecast and manage costs associated with payment processing. Additionally, consider negotiating with potential providers to explore whether there are opportunities for customized pricing packages based on your unique business needs.

Some gateways may offer flexibility in adapting their fee structures to accommodate high-volume transactions or specific industry requirements.

5. Security & Fraud Prevention

Prioritizing security is non-negotiable when dealing with online transactions. Ensure the chosen gateway adheres to industry standards such as PCI DSS and employs robust data encryption protocols.

Advanced fraud detection tools and chargeback protection features are essential in minimizing financial risks associated with fraudulent transactions and fostering trust and confidence among your customers. Consider conducting regular security audits and staying informed about the latest advancements in cybersecurity to proactively protect your customers’ sensitive information and maintain the integrity of your payment processes.

Transparency in your security measures can also serve as a powerful marketing tool, reassuring customers of the safety of their transactions.

6. Ease of Integration

Considering your store’s technical capabilities is essential for seamless integration with the chosen payment gateway. Assess your development resources and opt for a gateway with well-documented APIs and plugins that align with your ecommerce platform.

For example, if you run an online store on Magento, then you should look for ecommerce payment gateways that are Magento compatible.

Look for ecommerce payment gateway providers that offer technical support and guidance, particularly if your store needs more in-house development expertise. Additionally, explore whether the gateway provides developer resources, such as forums or community support, fostering collaboration and knowledge-sharing among developers.

A well-supported integration process not only ensures a smooth initial setup but also facilitates ongoing maintenance and updates as your ecommerce platform evolves.

7. Customer Support

Reliable customer support is paramount for resolving any issues promptly. Evaluate the availability and responsiveness of the gateway’s customer support channels, such as toll-free hotline, email, and live chat.

Ensuring that customer support aligns with your operational hours guarantees timely assistance when needed, fostering a positive merchant experience. Consider engaging with the support team during the evaluation phase to simulate potential troubleshooting scenarios and assess their ability to provide effective solutions.

Some ecommerce payment gateways may offer dedicated account managers or priority support for certain plans, providing your business with an extra layer of personalized assistance.

8. International Reach

For stores with international reach, selecting an ecommerce payment gateway that supports multiple currencies and local payment methods is essential. This facilitates smoother transactions for international customers and improves conversion rates by offering familiar and preferred payment options in specific regions. Additionally, explore the gateway’s capabilities in handling cross-border transactions and compliance with international regulations.

Consider collaborating with localization experts to ensure that your payment processes align with cultural expectations and legal requirements in various regions, enhancing the overall user experience for your global customer base.

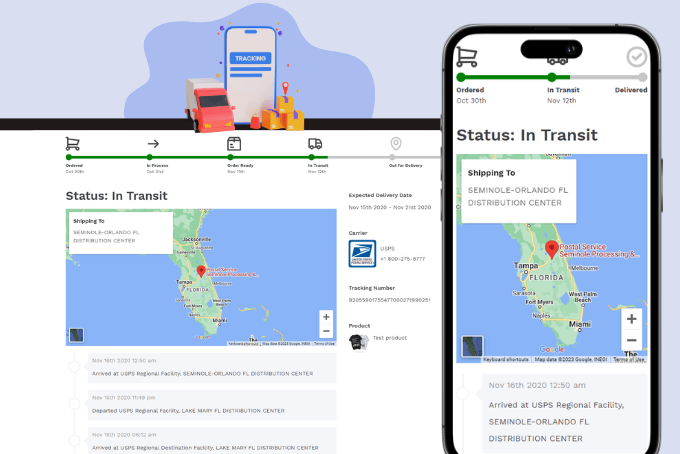

For example, in the thriving world of ecommerce in China, where Taobao, 1688, or Alibaba dominates, finding the ideal Chinese delivery tracking collaborator can enhance your quality of service and give you opportunities when compared to the others.

9. Scalability & Growth

Choosing an ecommerce payment gateway that can scale with your business is critical for long-term success. Assess volume limits to ensure the gateway can handle projected transaction growth without performance issues or excessive fees.

Opt for providers that offer flexible plans or customizable options, allowing your store to adapt to evolving needs and seamlessly accommodate growth. Regularly review your transaction patterns and growth projections, and communicate proactively with your chosen payment gateway to ensure that your evolving requirements are met.

A partnership with a scalable payment gateway addresses current needs and builds a foundation for sustained business growth and success in the dynamic ecommerce landscape.

Top 3 Popular Payment Gateway Options

The perfect gateway can be tailored to your business’s unique needs and aspirations. These top 3 heroes handle the money magic, ensuring smooth transactions and happy customers. But with so many options out there, choosing the right ecommerce payment gateway can give you an edge over the other business entrepreneurs:

1. Stripe

Imagine a gateway built for seamless scaling and endless customization. That’s Stripe in a nutshell. Their developer-friendly APIs and robust documentation make integration a breeze, even for technical newbies. But Stripe’s magic goes beyond coding ease.

They boast a treasure trove of features, from supporting all major cards and digital wallets to offering cutting-edge BNPL options like Klarna and Afterpay. This vast selection makes them a versatile choice for businesses of all sizes and across a multitude of industries.

Imagine a startup founder effortlessly taking payments through their mobile app or a global marketplace seamlessly processing transactions from far-flung corners of the world – Stripe empowers both with its agile infrastructure and flexible tools.

2. PayPal

The familiar blue button acts as a beacon of trust for millions of online shoppers. When customers see it at checkout, their anxieties fade, replaced by the familiar comfort of PayPal’s renowned buyer and seller protection.

This built-in trust mechanism is invaluable, boosting conversion rates and building customer loyalty. Beyond trust, PayPal excels in catering to specific needs. Their recurring payment and invoicing features are tailor-made for subscription-based businesses, ensuring smooth recurring transactions and streamlined customer management.

Think fitness studios effortlessly processing monthly memberships or online publications seamlessly collecting subscription fees – PayPal facilitates recurring revenue with effortless grace. However, their higher transaction fees compared to some competitors might necessitate careful consideration for high-volume businesses.

3. Square

Forget the separation between brick-and-mortar and online worlds. Square gracefully bridges the gap, offering a unified payment experience for modern businesses.

Their sleek POS systems seamlessly integrate online and offline transactions, giving you a holistic view of your sales, regardless of channel. But Square doesn’t stop at mere payment processing. Their arsenal of features extends to inventory management tools, customer loyalty programs, and even payroll solutions.

Imagine a bustling café effortlessly managing both dine-in and online orders or a boutique clothing store offering loyalty rewards and streamlined employee payments – Square empowers businesses to operate with an interconnected efficiency.

Final Words

Choosing the right ecommerce payment gateway is about finding the best match for your unique needs and customer base. So, keep exploring and comparing features, and feel free to test-drive different options before making your final decision. With the right gateway by your side, your ecommerce business journey will be paved with seamless transactions, built-in trust, and limitless growth potential.