Restocking Fee 101: The Ultimate Guide for Online Retailers

The return policy of online stores is like a double-edged sword that encourages customers to purchase things they are not bound to keep while adding extra costs and challenges to the retailers.

Return processing is an expensive procedure with additional costs, from shipping returned items to reselling them. According to a recent survey, on average, goods worth $166 million are returned for every $1 billion in sales.

Bearing the return processing cost solely means a huge loss in revenue. Online retailers are shifting from offering free returns to charging restocking fees to recoup this additional cost.

As an online retailer, should you charge restocking fees? What should you consider? If yes, how would you enforce restocking fees?

You will find answers to all these questions in this article.

What is Restocking Fee?

A restocking fee is an additional cost that online stores charge customers when they return products for refunds. Restocking returned products burdens businesses, as they need to go through certain processes that incur extra labor costs and expenses.

Since restocking return products impacts businesses financially, the restocking fees help cover the cost to a certain extent. In other words, the restocking fee compensates sellers for the inconveniences caused by returns.

However, apart from offsetting the costs of restocking returned items, there are other reasons behind charging restocking fees. Some common reasons are:

- Restocking returned items requires additional time and labor for testing and inspecting the item’s condition, repackaging, updating inventory status, etc. So, it acts as a charge for the extra labor investment.

- The shipping charge for returns adds a financial burden to businesses. Hence, this additional shipping charge can be covered by the restocking fee.

- During delivery or return, products may get damaged, which can decrease the resale value or make it completely inappropriate for sale. Thus, the loss incurred can be somewhat reduced by the restocking fee.

- Often, customers return items because they change their minds or purchase items they do not need. Therefore, charging a restocking fee discourages customers from making impulsive purchase decisions.

- There are plenty of customers who misuse the return policy. Usually, they order multiple items to benefit from higher discounts and keep some while returning the rest. So, the addition of the restocking fee can restrict such behaviors.

Although restocking fees give sellers an upper hand, they can discourage buyers from purchasing. That’s why it’s important to charge an amount that is quite easy for customers to accept and take positively.

So, how much is a restocking fee?

The restocking fee varies depending on several factors, for instance, product value, return reason, business policy, profit margin, and so on. Usually, this cost is a certain percentage of the product’s purchase price. A standard restocking fee ranges between 10-25% of the total purchase price.

8 Things to Consider Before Enforcing a Restocking Fee

The implementation of the restocking fee is a challenging task, as there are several risks associated with it. A higher charge can make you lose customers, whereas a lower charge can affect your revenue and profit.

Here are 7 key factors that you must take into consideration when deciding on the restocking fee.

1. Local Laws and Regulations

The first factor to consider is the terms and conditions of the local laws and regulations to avoid legal issues such as potential lawsuits, fines, and so on.

Restocking fees fall under the Service and Other Activities classification, which is subject to business and occupation (B&O) tax.

The consumer protection law is different for every state and country. These laws somewhat determine the percentage limit of the purchase price that retailers can charge as the restocking fee. Hence, it is best to consult with legal counsel before implementing the fee.

2. Conversion Rates

The restocking fee is one of the crucial factors that influence the conversion rate of a business. According to a recent survey, more than 80% of first-time customers prefer to review the return and refund policy before making a purchase. A high restocking fee can have a negative impact on the customer’s purchasing decision, resulting in a lower conversion rate.

Since online shoppers cannot physically inspect products, they are less likely to want to spend a significant amount of money on items they may need to return. Hence, it’s ideal to set a minimal percentage that helps recoup the loss while also encouraging customers to buy.

4. Your Profit Margins

Enforcing the right restocking fee is interlinked with establishing a balanced profit margin. The goal of a business is to maximize profit by generating revenue. On this note, the restocking fee is insufficient to cover the additional cost.

Hence, the rest of the expenses that impact revenue can be recovered through selling the products with higher profit margins. Setting higher profits on some of the items can serve as compensation for the returned items.

5. Return Processing Costs

A fair restocking fee is an amount that is imposed considering the real cost retailers spend during processing returns. The costs associated with return processing include return shipping, reshipping (for replacement goods), inspecting, repairing, cleaning, labor for paperwork, remarketing, repackaging, and so on.

When enforcing the restocking fee, all of these costs should be calculated so that the business has a clear picture of the actual additional costs it must prepare to cover. Although the entire amount cannot be compensated, a reasonable restocking fee can be imposed.

6. Communicating Return Policy

A transparent return policy builds trust between customers and brands. When customers make an informed purchasing decision after considering all the charges, they will become loyal and recurring customers. On the other hand, if customers experience hidden or sudden extra expenses, it makes them lose trust.

Therefore, it is essential to state the return policies clearly, mentioning all the terms and conditions, including the percentage of the restocking fee and product conditions eligible for repair, exchange, and partial or full refund.

Learn More: How to Write a Return Policy: A Complete Guide

7. Customer Feedback

Customer feedback is an excellent source for understanding their pain points and making it work for the company’s benefit. You can proactively collect customer feedback to find out whether the return window is too short for returning the goods or whether the restocking fee needs to be adjusted.

In addition, evaluating client feedback and acting upon it enhances the relationship and fosters trust. Hence, giving customer feedback the highest priority when setting the restocking fee promotes long-term business sustainability.

8. Brand Reputation

A brand’s reputation is crucial to attracting customers and driving them away. Customers satisfied with restocking fees tend to stay loyal to the brand and encourage others to purchase.

On the contrary, if brands impose unreasonable restocking fees, existing customers tend to avoid that brand and influence others as well. Moreover, there is a chance of getting negative reviews that can negatively impact the brand’s reputation.

So, when deciding on the restocking fee, it’s crucial to set a value that enhances the brand image.

How to Charge a Restocking Fee?

Discounts, flash sales, cashback, or free shipping are all lucrative offers that encourage customer engagement and boost sales. However, customers may be discouraged from purchasing when they see a restocking fee as an additional charge.

So, how can you charge a restocking fee without negatively impacting customers’ purchasing decisions?

The following are some excellent alternatives you can use to charge restocking fees without mentioning them as an additional cost category.

1. Deduct from Refundable Amount

The key factors determining the refundable amount are the reasons for the return and the product’s condition. If the customer receives the wrong or defective product from the seller, then the seller must refund the full amount or provide a replacement.

However, if the return reason is the customer’s change of mind or the returned product shows signs of use, the seller can provide a partial refund after deducting the restocking fee. For example, a customer returned a dress worth $100. If the restocking fee for that dress is 20%, the customer will receive a partial refund of $100 – $20 (restocking fee) = $80.

2. Charge a Return Shipping Fee

The online retailer is responsible for the return shipping fee only if the customer receives products that are either something they never ordered or damaged/defective items. For return reasons other than this, sellers can charge a return shipping fee from the customer.

The return shipping fee is one of the major expenditure categories associated with return processing. Hence, sellers can save a lot of money if the customer pays the return fee. However, for tracking the return packages, sellers have to provide an unpaid return label to the customers. They may also allow customers to select an authorized courier of their choice and buy a return label for the returns.

3. Allow to Exchange Items of Lower Value

Additional charges often discourage customers from purchasing products. So, whether customers return items or do not purchase at all, the seller is the one that gets affected. To make this a win-win situation for both, exchanging products of lower value without imposing extra expense on the customer can be a great option.

For example, if a customer returns a $200 product where the refund amount is $170 after considering the restocking fee, you can offer them an exchange option for an $170 item. This way of charging restocking fees encourages customers to explore other products within the inventory. As a result, this can lead to additional sales opportunities.

4. Offer Store Credits Instead of Refunds

Store credits are a great alternative to cash refunds for motivating customers to return to the store in the future.

A cash refund means you need to invest more money and labor to resell the returned item or sell it at a lower price in case the product loses its original quality.

On the contrary, store credits (or gift cards) retain the funds within the system and bring the customer back to your store. This way, you do not have to lose the entire transaction value and save a significant amount of money.

Restocking Fees FAQ

Some of the most frequently asked questions about restocking fees and their answers are listed below.

Does Amazon charge a restocking fee?

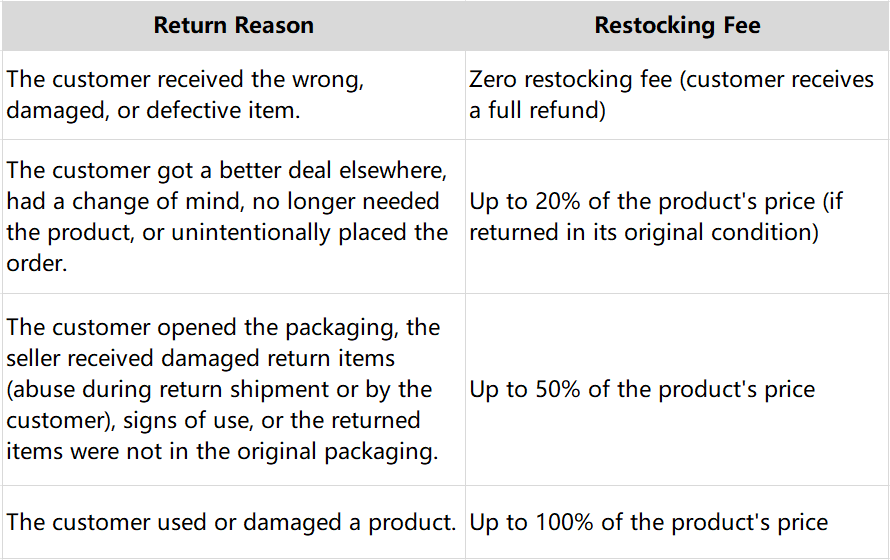

Yes, Amazon allows customers to return items within 30 days and experiences a return rate of around 15%. Therefore, depending on the product type, condition, and reason for return, Amazon charges a restocking fee of 20%-100% of the item price.

Here are the different restocking fees based on the reason for the return.

Is there any restocking fee calculator?

Yes, several restocking fee calculators allow easy calculation of the tour restocking fee.

As the restocking fee is a specific percentage of the product’s price, a basic calculator has options for entering the item’s price and the restocking fee percentage. These calculators are a useful tool for calculating restocking fees for a large quantity of products.

How about restocking fee laws by state in the US?

There are no federal laws in the US that specify the restocking fee. However, every state has its own distinctive return and refund laws. The merchants must state their refund policies in detail to the customers. If the refund policy includes the restocking fee, it must be highlighted to inform the customers of this additional cost.

However, even if there is no return and refund policy, the federal position on consumer rights to return items generally applies. Except in some special circumstances, customers can return items or claim refunds, which are:

- Customers can cancel or return orders within the cooling off period (specific timeframe after purchase), as per the FTC’s ‘Cooling Off Rule.’

- If the customers get faulty items, such as damaged/defective gadgets or wrong accessories, the seller or shipping company is entirely to blame.

- If the seller violates the terms of the sale, such as failing to deliver the order, being unable to provide service on the agreed-upon date, shipping a damaged item, and so on.

Are restocking fees legal?

The legality of the restocking fee depends on state law. Usually, the restocking fee is legal, with certain exceptions. Generally, the consumer protection laws of a state regulate restocking fees.

To make restocking fees legal, there are some criteria that sellers must follow:

✔ The rule of the restocking fee must be included in the refund policy with clear terms and conditions.

✔ The restocking fee should be disclosed prior to the sale.

✔ The restocking fee should match the actual restock processing expense and also be reasonable.

However, there are some circumstances that make charging the restocking fees illegal, including:

- When the restocking fee is kept hidden from the customer.

- Charging when the return reason is ‘wrong product’ (items that customers never ordered).

- Charging for returning damaged or defective items.

- If the products are returned for late deliveries (customers didn’t receive the items within the promised timeframe).

- When the fee is more than 50% of the actual purchase price (for returning unused products).

Enforce a Restocking Fee with ParcelPanel

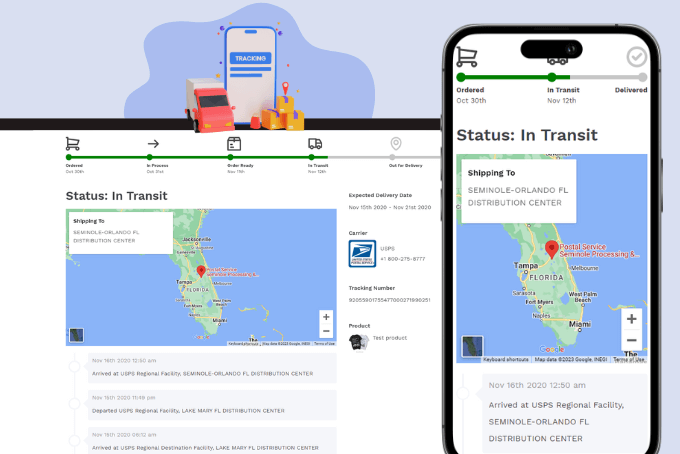

Handling the restocking fee is a challenging task when businesses have an endless flow of return requests to process. The ParcelPanel Returns & Exchange app is a returns management app that can help merchants enforce a restocking fee.

This app offers solutions for refunds and exchanges to eCommerce businesses of all sizes. Its automated return solutions streamline return processing. Merchants have the customization option to edit the descriptions of the return solution to provide clear instructions and maintain transparency with customers.

Moreover, merchants can set a fixed return fee or provide a percentage-based fee (1-100%) to collect the restocking fee as per the return reason or solution. Based on the input, the app will show the restocking fee on the customer’s screen when they submit their return request.

Do you want a hassle-free way to collect restocking fees?

Install ParcelPanel Returns & Exchange to simplify restocking fee management. It’s FREE!!!

![Top 10 Loop Returns Alternatives and Competitors [2025]](https://images.surferseo.art/355d37b8-6936-4be4-b677-f5314b151724.png)